Ben Ford, Head of Sales at Yodlee explains how their solutions power and enable digital financial innovation across the globe.

Q: How does your role relate to the FinTech sector?

A: I work with FinTech companies who are considering using a data aggregation partner, advising on best practice and commercial considerations. Working closely with industry bodies, we try to enable FinTechs to thrive whilst also facilitating collaboration with established organisations where possible.

Q: What are you doing in the FinTech space?

A: Yodlee is innovating in the financial wellness space with additional offerings that are underpinned by our data aggregation and categorization solutions.

Research from APAC and the US shows that consumers are often seeking easy-to-use and easy-to-consume personal financial advice and guidance. New technologies enable this to be delivered easily via a website or app, and tailored to an individual’s unique position using aggregated and categorized information about their financial position and spending patterns.

We also continue to develop and refine solutions to aid lenders, payment providers and software and CRM platforms, as well as being closely involved in the development of the Open Banking framework.

Q: How do you see financial services changing in the next five years?

A: Open Banking and Open Data, as well as the rise of challenger or ‘neo’ banks, is likely to disrupt the financial services industry and provide consumers with greater control and flexibility over to whom they entrust their financial affairs.

Watch Yodlee launch their AI-powered financial coach at Finovate.

About Yodlee:

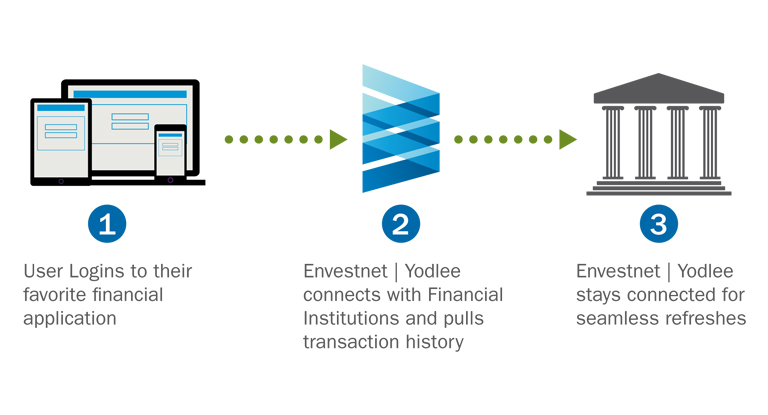

Envestnet® | Yodlee® is a leading data aggregation and data analytics platform powering dynamic, cloud-based innovation for digital financial services. Our platform has proudly fueled innovation financial institutions (FIs) and fintech for over 17 years ultimately helping consumers get better lending rates, lower fees, higher returns, and more. We partner with more than 1,100 financial institutions and fintech innovators, including 13 of the top 20 U.S. banks, enabling a massive data network associated with tens of millions of consumers who use platform-related personalized apps and services. Notably, 70 percent of the financial data is gathered via structured data feeds with financial institutions. The power of Envestnet | Yodlee and our unique point of difference begins with the massive scale of financial data within our platform which is utilized to fuel Envestnet | Yodlee’s Data Intelligence capabilities. Our unique point of difference also extends to Envestnet | Yodlee’s bank-level security, 80 issued patents, best-in-class data from over 17,000 sources, and our formal agreements with leading financial institutions for responsible and secure management and exchange of data.