FinTech is a powerful ecosystem and it is a force for generating positive, innovative change across financial services. FinTech evolution is centred on innovative, disruptive technologies; innovations which have the potential to significantly enhance the cyber security profile of financial services once thoroughly tested. However, due to the emerging nature of some the technologies employed, it is possible that there can be unintended consequences, including vulnerabilities to cyber threats.

Cyber threats are broadly defined as criminal activity through interconnected devices, and include such issues as ransomware, phishing, data breaches, system failures, cyberwarfare, fraud, and distributed denial of service attacks. There is scope for devastating consequences if the security risks posed to FinTech are not understood and managed with these risks in mind.

Delta Insurance has recently released a whitepaper entitled ‘The Evolution of Cyber Threats’, discussing some of the top risks within the cyber landscape. The paper couldn’t be timelier, with cyberattacks -along with nuclear weapons and radical terrorism- considered one of the most dangerous global threats .

The rise of Artificial Intelligence (AI) and Blockchain along with other technologies mentioned in the paper bring with them both exciting opportunities but also new threats. The unpredictability of AI and the relatively untested nature of blockchain technology could see an array of new risks enter the cyber landscape.

While New Zealand has slowly built up its cyber resilience, the geographical isolation once thought of as a form of protection is no longer a security shield. New Zealand remains one of the ‘Cyber Five’ alongside Australia, South Korea, Japan, and Singapore who appear to be more vulnerable to attacks than any other Asian economy .

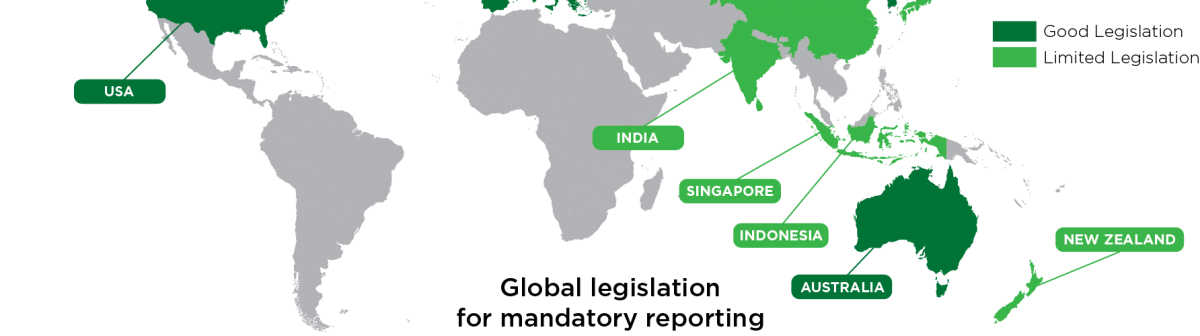

Across the globe, governments and courts are recognising the need for stronger reform in the event of a data breach, with the New Zealand Privacy Commissioner also making recommendations to implement fines on those who fail to keep personal data safe. Following the lead of the European Union and Australia, New Zealand will most likely introduce a new regime by the end of 2018.

FinTech providers now require a comprehensive risk management strategy, covering all aspects of the cyber security risk spectrum. Cyber insurance is being recognised around the globe as an essential part of any cyber security strategy, designed to mitigate risks from new technologies.

Some forecasts predict the global cyber insurance market will grow from $4 billion to $20 billion by 2025. The cyber insurance market in New Zealand is currently worth around NZD$10-15 million, but it is likely to climb to NZD$50 million by 2020, with potential to reach over NZD$100 million by 2025, as individual business in New Zealand seek to minimise the impact of potential cyberattacks.

For further information, please see the Delta Insurance white paper here.

Want to know more? Sign up for the FinTechNZ update, it’s free and will take less than a minute!

Somani, J., & Wellers, D. (2017). Securing Your Digital Future: Cyber Trust As Competitive Advantage. Retrieved from https://www.digitalistmag.com/digital-economy/digital-futures/2017/04/20/securing-digital-future-cyber-trust-as-competitive-advantage-04998170

Deloitte. (2016). Deloitte 2016 Asia Pacific Defense Outlook. Retrieved from https://www2.deloitte.com/sg/en/pages/public-sector/articles/deloitte-2016-asia-pacific-defense-outlook.html.