Last month’s newsletter began with the question; “Is Open Finance real life, or is it just fantasy? “. This was a precursor view on Open Finance progress. By the time you read this update we will have just released the Open Finance Project of Aotearoa report, truly an example of collaboration that incorporates the views and recommendations from FinTechNZ membership, other membership bodies, general public, ministries, business incumbents, the tech community and more. We have timed this to support the development and implementation of the proposed CDR legislation, which Minister Clark tipped to be going through parliament before the end of the year. If you missed the launch, you can review the session here and download the report here.

Membership Value:

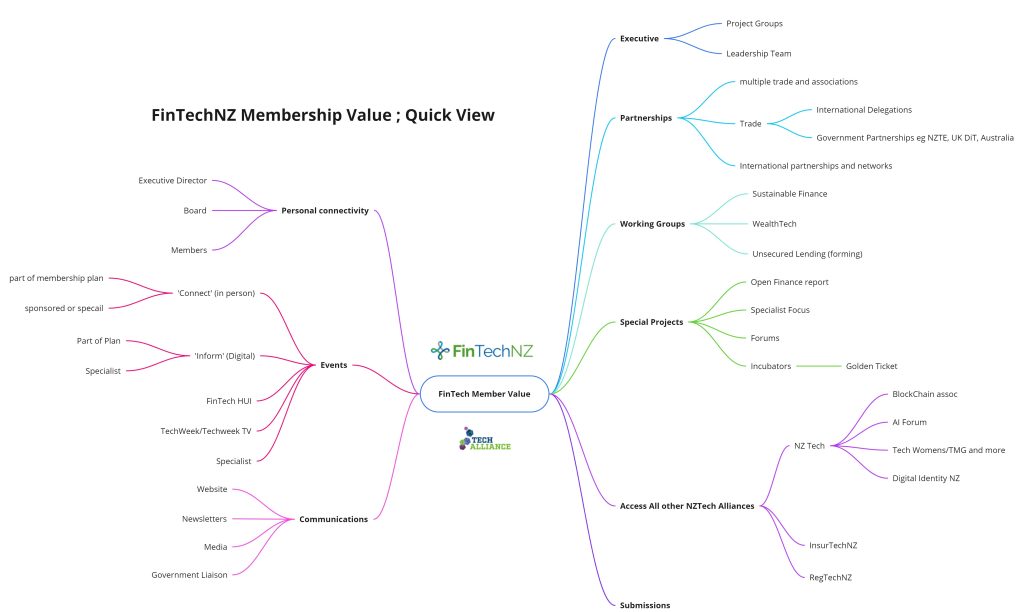

This month I would like to explore and reiterate the dimensions of membership value, an often-mentioned topic that goes to the heart of why people join FinTechNZ. I have noticed that sometimes members lose sight of what is on offer, how best to capture value and leverage opportunity. I hope the below will bring some options to light.

So what does an active FinTechNZ community look like? How do we deliver you value?

Like so many community membership organisations the reasons people join, engage, generate ideas, survive and thrive – and in some cases drift away, is as mixed and as varied as our members. To use a gym analogy, the more you take up what’s on offer the best you can receive value, but you can also help shape the gym classes, or in our case the FinTech community. So I thought today I would take a few moments to update you one some of the work we do, reiterate what’s on and how to leverage and get the greatest value from your membership.

You can click on this link to view a clearer image of the mind map below, created to visually highlight some of the membership benefits available to FinTechNZ members.

Status update…

Recently the Executive Council met to review how we are doing and to start the strategic planning for the 2023 budget year and beyond. As a quick summary of progress: Despite all the challenges of Covid-19 (and especially the impact on in-person events) we still retain 170+ members, have taken on some truly hefty projects, are running probably more events than ever, and with a dedicated team, are doing all this while delivering a humble budget surplus. Our Purpose is enabled by our Connect, Advance and Promote formula and is truly on track. We can’t wait to get back to more in-person events and reactivate our international trade activities which we know many members really seek. Thankfully it looks like we are going to get back into it, get overseas and re-engage with the global marketplace soon. So perhaps as a recap, let’s explore what’s available – and where can you and anyone in your team get more involved?

Events

Each month FinTechNZ is running multiple events under FinTechNZ ownership, or in association with other Tech Alliance members. Many are part of the membership plan, some are sponsored. While most events remain a digital only format until June, we are gearing up to a fast return to in-person events. Using our ‘theme’ approach we have approx. 10 opportunities in development until the end of the calendar year. We invite you to host, lead or present at one of our upcoming FinTechNZ events. Don’t forget Techweek22 as this is an additional opportunity as well! And – we are looking for speakers to appear on Techweek TV!

FinTech Hui

We are delighted to announce the return of the FinTech Hui, this year to be held at the Aotea Centre in Auckland on 31 October. This is a huge opportunity for involvement with top speakers and content, separate streams of interest and a VIP Dinner experience. We are developing the sponsorship plans and content, inviting early expressions of interest. Contact Jason Roberts in the first instance.

Board, Working Groups and Projects

Every year we have elected board seats for what is a highly active, supportive and engaged board (thanks all!). We also have a very active Sustainable FinTech (previously named ESG) working group, a WealthTech group and cross membership events and collaboration with others such as FSC, InsurTech, RegTech, DINZ, AI Forum, BlockchainNZ and more. In the past FinTechNZ was instrumental in ‘incubating’ InsurTechNZ, now it is its own association. We are always open to exploring new projects and have an emerging interest in exploring an ‘Unsecured Lending focused’ working group. Participation here is not only about engaging with other respected business leaders and getting the latest insights, but is also a chance to help shape our market activity and focus.

Major reports, projects and collaborations.

As you read this newsletter FinTechNZ has just launched the Aotearoa Open Finance Report, and as we speak is collaborating with TIN100 for the FinTech report due to be launched on 6th April.

Deloitte and FinTechNZ

In July/August Deloitte plans to publish the 2022 New Zealand Fintech Pulsecheck – Open Banking and Beyond report, this has come about through joint participation. A separate email inviting responses to the Open Banking And Beyond survey described in the February newsletter, will be sent out soon – please keep your eyes peeled for that. If your organisation accesses customer data from banks or other FS organisations in a ‘CDR’ or ‘open banking’ manner, or some comparable alternative including use of an intermediary, we would love to have your views represented in the study. As our government moves towards shaping CDR legislation for New Zealand it will be important to consider the wider views across the industry and this study will be an important enabler of that. In the background we are always interested in providing submission feedback, to work with Ministers, engage with government agencies and other groups. We anticipate – indeed plan for new projects, particularly related to Open Finance as we have good capability and understanding here with views from across the sector.

Communications: Social Media, Blogs, Sharing news and updates.

Recently we shared blogs (e.g. Josh Daniell @Akahu with his views on Open Finance) have shared reports, provided significant market announcements and updates from a host of members via our LinkedIn channels and website. We all want to see your news and our channel is here to help share with our network.

Trade and international partnerships

Right now FinTechNZ is partnering to plan trade delegations and/or supported opportunities to attend the Dubai Seamless conference on 31 May-1 June and following on from this UK Tech week 7-11 June – or indeed a four week break until FinTechWeek London 11-15th July. We have access to other event hosts, NZTE and UKDiT leadership and support, not to mention speaking and trade exposure networking and more.

Finally, He Tangata, He Tangata, He Tangata, it is the people, it is the people, it is the people

FinTechNZ is all about the people. If you seek to talk to someone, create an ‘add value’ connection, would like to explore membership value as noted above, simply contact me, explore insights from our executive leadership team, or reach out to other folk you come across. The one thing I have been delighted by is how generous people are and issues of competition are nearly always, very much secondary to advancing sector opportunity. We are a dynamic, interesting and generous bunch!

Member announcements

NZ Open Finance Showcase: Akahu is hosting an online event to showcase Kiwi products that have been built on top of open finance infrastructure. Join to see rapid-fire product demos of open finance-enabled products.It takes place from 12pm-12.40pm on Tuesday, 12 April. Click here for more information and registration.

Nga Mihi,

Jason Roberts

Executive Director