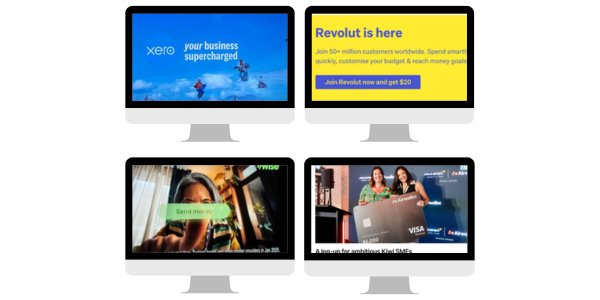

May 2025 has been a pivotal month for New Zealand’s fintech sector. The market is heating up dramatically – a simple metric is the four major fintech players launching mainstream advertising campaigns this month alone, a level of retail marketing activity unprecedented in Aotearoa/NZ, except perhaps for Kiwi hero brand Xero (who have just launched tap to pay in collaboration with Stripe. This signals international players spotting opportunities to unlock an met market and/or compete with incumbents.

Westpac NZ’s decision to waive API fees for fintechs marks a meaningful step toward open banking, while Xero’s impressive results ($2B revenue, $640M earnings) demonstrate what homegrown success can achieve with proper support.

As we approach mid-2025, critical decisions about open banking enablement, the call for specialist banking licenses, and ESAS payment network access will all help shape our ecosystem’s future. While NZ-grown fintechs may face challenges from both international competitors and well resorced international competitors, we see this increased activity both validating our market while also creating opportunities for innovative Kiwi solutions. So – bring it on Xero, Revolut, Stripe, Wise, Airwallex and more!

This month, we’re taking an assertive stance on our fintech future. While recent developments are promising, we need stronger conviction and clearer direction from government, ministries and regulators to truly enable competitive innovation. Two critical questions are front of mind on the CDR ‘rules’: Will MBIE follow through on designating the retail payment network? And will there be movement on specialist bank licenses with proportionate regulatory frameworks? Customer adoption is our number one priority and must remain front of mind. The UK shows what’s possible with strong consumer adoption and a globally competitive fintech industry. Without similar focus, our domestic fintechs risk being outpaced by well resourced international competitors and local incumbents.

We invite you to join the crucial discussions taking place and help build a financial system that works for all New Zealanders. We also encourage you to support our Fintech for Good initiatives, including my own personal fundraising effort for the Lifewise Auckland Sleepout on July 10 to address homelessness in our community.

You can read more about Jason’s thoughts on our fintech future here.

🔔 FinTechNZ Updates

Fintech Festival Celebrates Innovation

The recent Fintech Festival was a tremendous success, bringing together over 300 people to support New Zealand’s innovative founders. The event showcased 14 remarkable startups from the 2025 Fintech Lab cohort, including Scores4All, Otto NZ, Money Sweetspot, IPromise, Sevaka, IndigiShare, Rebit Money Transfer, Homely, Indus, tandym., Goldie, PolicyCheck, eccuity, and Paysquad. The festival embodied the collaborative spirit of our community—ambitious ideas being supported by the sector, private partners investing in our economy’s future, and policymakers acknowledging the importance of our startup ecosystem. As Creative HQ noted, it was “a wild ride” that highlighted the strength of our fintech community.

Techweek25 Insights

Techweek25 featured outstanding fintech content, including Xero’s “Powering Productivity” session highlighting their report that digital adoption represents an $8.6 billion opportunity for small businesses in Aotearoa, and NZTE’s “Global Growth Playbook” on international expansion strategies. Stripe explored how subscription and embedded payments are transforming Kiwi SaaS businesses, while Airwallex shared practical insights on conquering global markets. Congratulations to Lee Timutimu, recognised as the Most Inspiring Individual at the NZ Hi-Tech Awards.

Check out Techweek25’s event wrap ups

International Fintech Trends

Two major reports highlight the accelerating global fintech landscape. The UK’s Open Banking Implementation Entity reports that 1 in 5 consumers and small businesses are now active open banking users, with consumer adoption finally catching up to business use. The report demonstrates strong growth across both data and payments applications, revealing shifting trends in the thriving open banking ecosystem. Meanwhile, India’s digital payments revolution continues at breathtaking speed, with UPI (Unified Payments Interface) now processing over 10 billion transactions monthly valued at ₹750B+. With 1.3B+ digital payment users and a 48% annual growth rate, India is on track to reach a $1 trillion digital economy by 2026. The country’s regulatory innovations have made it a global case study in financial inclusion, offering valuable lessons for New Zealand’s own open banking journey.

Read the full reports on UK Open Banking Impact Report and India’s Digital Payments Revolution.

📅 Upcoming Events

Digital Payments for All Workshops

Date: 3 June, Auckland & 4 June, Wellington + Online

Join us alongside RBNZ and CoFR to explore how fintech can improve access to basic transaction services for financially disadvantaged Kiwis. Auckland session: 3 June, 10:00 AM (10 spots left!). Wellington session: 4 June, 1:00 PM (online spaces available). This is open to FinTechNZ members only.

Register now for Auckland

Register now for Wellington or Online

Capital Raising in Uncertain Times

Date: 5 June, Auckland

Hosted by NZX, explore effective capital raising strategies with industry leaders including Darrin Grafton (Serko), Susannah Batley (Sharesies), and more. Thursday, 5 June, 12:00-1:30pm at NZX Capital Markets Centre, Auckland.

Register here

Open Banking Summit 2025

Date: 2 July, Auckland

Hosted by Akahu, hear directly from Hon Scott Simpson and MBIE about New Zealand’s incoming open banking regime. Wednesday, 2 July, 9:30am-1:00pm at Chapman Tripp, Auckland.

Secure your spot

📢 Community Noticeboard

POLi Partners with ASB for Open Banking

Following Minister Simpson’s announcement that regulated open banking will take effect from December 2025, POLi has partnered with ASB to enable secure payments without customers sharing login credentials. POLi plans to transition all major bank payments to open banking APIs by December. “This is a game changer for the sector,” says Andrew Simmonds, POLi’s Commercial Director.

Have Your Say: Review of Access to Financial Advice

FMA is reviewing challenges and opportunities in access to financial advice, with a focus on demographics, digital advice, remuneration, and business models. This review presents a valuable opportunity for FinTechNZ members to influence how financial advice services evolve in New Zealand. Your input can help shape policies that support innovation while ensuring consumer protection in the digital advice space.

Closes: 30 May 2025.

Basic Transaction Accounts Consultation

RBNZ and CoFR seek feedback on reducing barriers to opening basic transaction accounts, aiming to improve financial inclusion for underserved communities. This consultation directly relates to our ongoing work supporting the 200,000+ Kiwis currently excluded from basic financial services. Your insights on how fintech solutions can bridge these gaps will be crucial in developing practical, scalable approaches to financial inclusion.

Closes: 18 June 2025.

SXSW Sydney Pitch 2025

Applications are now open for SXSW Sydney Pitch 2025. This year’s winner will present at either SXSW Austin or London 2026, with flights and passes included. Eligible startups must have launched after October 2021 with under $8M in funding. Relevant categories include Enterprise & AI, Retail & Commerce, and Climate Tech. The Startup Village is also accepting expressions of interest.

For details, visit the SXSW Sydney website.

Lifewise Sleepout Fundraiser

I’m participating in the Lifewise Auckland Sleepout on 10 July to raise funds for those facing homelessness. My goal is to raise at least $4,000 – will you help? Please consider donating to support this crucial cause.

🔎Looking ahead

As we move into June, we’ll continue advocating for clear regulatory frameworks that enable fintech innovation. Your participation is crucial in shaping the future of financial services in New Zealand.

Ngā mihi nui,

Jason Roberts

Executive Director